A typical Freemason Jew-dicial proselyte servant of the jews and their god wannabe YHWH.

Dear Saints of the Lord God and King Jesus,

Many of you understand the planning these Hasidic Talmudic Pharisaic Vipers and their Noahide Proselytes have, concerning their Ultimate World Odour to eliminate the Name of Jesus the Christ and you his saints from among the Inhabitants of the earth. You also know the so-called forgery the “Protocols of the forged People of zion” (Pun intended) certainly is no hoax, for it matches the scriptural description of the Mystery Babylon, Mother Harlot of the Earth in Jesus Revelation sent unto his servants by his angels.

This article is not for the Proselytes of the jews, the braindead, the brainwashed apostates nor the ignorant masses, but only for those who understand and know who their LORD GOD the Creator is.

The below excerpts may reveal what Trumps Tax Bill has just done in eliminating the False but Criminal arguments of the D.O.J using that fake argument that the 16th Amendment of the Constitution of the United States superseded Article 1, Section 8.

Perhaps they are now secretly moving in this scheme……………………

http://watch.pairsite.com/protocols-of-zion.html

PROTOCOL No. 20

1. To-day we shall touch upon the financial program, which I put off to the end of my report as being the most difficult, the crowning and the decisive point of our plans. Before entering upon it I will remind you that I have already spoken before by way of a hint when I said that the sum total of our actions is settled by the question of figures.

2. When we come into our kingdom our autocratic government will avoid, from a principle of self-preservation, sensibly burdening the masses of the people with taxes, remembering that it plays the part of father and protector. But as State organization cost dear it is necessary nevertheless to obtain the funds required for it. It will, therefore, elaborate with particular precaution the question of equilibrium in this matter.

3. Our rule, in which the king will enjoy the legal fiction that everything in his State belongs to him (which may easily be translated into fact), will be enabled to resort to the lawful confiscation of all sums of every kind for the regulation of their circulation in the State. From this follows that taxation will best be covered by a progressive tax on property. (16th Amendment Theft) In this manner the dues will be paid without straitening or ruining anybody in the form of a percentage of the amount of property. The rich must be aware that it is their duty to place a part of their superfluities at the disposal of the State since the State guarantees them security of possession of the rest of their property and the right of honest gains, I say honest, for the control over property will do away with robbery on a legal basis.

4. This social reform must come from above, for the time is ripe for it – it is indispensable as a pledge of peace.

WE SHALL DESTROY CAPITAL

5. The tax upon the poor man is a seed of revolution and works to the detriment of the State which is hunting after the trifling is missing the big. Quite apart from this, a tax on capitalists diminishes the growth of wealth in private hands in which we have in these days concentrated it as a counterpoise to the government strength of the GOYIM – their State finances.

6. A tax increasing in a percentage ratio to capital will give much larger revenue than the present individual or property tax, which is useful to us now for the sole reason that it excites trouble and discontent among the GOYIM. (Now we know the purpose of the 16th Amendment!!).

7. The force upon which our king will rest consists in the equilibrium and the guarantee of peace, for the sake of which things it is indispensable that the capitalists should yield up a portion of their incomes for the sake of the secure working of the machinery of the State. State needs must be paid by those who will not feel the burden and have enough to take from.

Satan’s Sanhedrin who will anoint their False King soon, that man of sin, Son of Perdition KJV 2 Thes. 2 (KJV Rev. 13 through 17)

see how the Clinton Ad-men-struation set this up during the Y2K shem sham of shame..

http://www.samliquidation.com/section_16.htm

8. Such a measure will destroy the hatred of the poor man for the rich, in whom he will see a necessary financial support for the State, will see in him the organizer of peace and well-being since he will see that it is the rich man who is paying the necessary means to attain these things.

9. In order that payers of the educated classes should not too much distress themselves over the new payments they will have full accounts given them of the destination of those payments, with the exception of such sums as will be appropriated for the needs of the throne and the administrative institutions.

10. He who reigns will not have any properties of his own once all in the State represented his patrimony, or else the one would be in contradiction to the other; the fact of holding private means would destroy the right of property in the common possessions of all.

11. Relatives of him who reigns, his heirs excepted, who will be maintained by the resources of the State, must enter the ranks of servants of the State or must work to obtain the right to property; the privilege of royal blood must not serve for the spoiling of the treasury.

12. Purchase, receipt of money or inheritance will be subject to the payment of a stamp progressive tax. Any transfer of property, whether money or other, without evidence of payment of this tax which will be strictly registered by names, will render the former holder liable to pay interest on the tax from the moment of transfer of these sums up to the discovery of his evasion of declaration of the transfer. Transfer documents must be presented weekly at the local treasury office with notifications of the name, surname and permanent place of residence of the former and the new holder of the property. This transfer with register of names must begin from a definite sum which exceeds the ordinary expenses of buying and selling necessaries, and these will be subject to payment only by a stamp impost of a definite percentage of the unit.

Local Freemason Courthouse, Temple and or Sinai-Gog

13. Just strike an estimate of how many times such taxes as these will cover the revenue of the GOYIM States.

WE CAUSE DEPRESSIONS

14. The State exchequer will have to maintain a definite complement of reserve sums, and all that is collected above that complement must be returned into circulation. On these sums will be organized public works. The initiative in works of this kind, proceeding from State sources, will blind the working class firmly to the interests of the State and to those who reign. From these same sums also a part will be set aside as rewards of inventiveness and productiveness.

15. On no account should so much as a single unit above the definite and freely estimated sums be retained in the State Treasuries, for money exists to be circulated and any kind of stagnation of money acts ruinously on the running of the State machinery, for which it is the lubricant; a stagnation of the lubricant may stop the regular working of the mechanism.

16. The substitution of interest-bearing paper (Fiat fakery) for a part of the token of exchange has produced exactly this stagnation. The consequences of this circumstance are already sufficiently noticeable.

17. A court of account will also be instituted by us, and in it the ruler will find at any moment a full accounting for State income and expenditure, with the exception of the current monthly account, not yet made up, and that of the preceding month, which will not yet have been delivered.

18. The one and only person who will have no interest in robbing the State is its owner, the ruler. This is why his personal control will remove the possibility of leakages of extravagances.

19. The representative function of the ruler at receptions for the sake of etiquette, which absorbs so much invaluable time, will be abolished in order that the ruler may have time for control and consideration. His power will not then be split up into fractional parts among time-serving favorites who surround the throne for its pomp and splendor, and are interested only in their own and not in the common interests of the State.

20. Economic crises have been produced by us for the GOYIM by no other means than the withdrawal of money from circulation. Huge capitals have stagnated, withdrawing money from States, which were constantly obliged to apply to those same stagnant capitals for loans. These loans burdened the finances of the State with the payment of interest and made them the bond slaves of these capitals .... The concentration of industry in the hands of capitalists out of the hands of small masters has drained away all the juices of the peoples and with them also the States …. (Now we know the purpose of the PRIVATE Talmudic Jewry Federal Reserve Bank Corporation and their theft of American Private Property!!).

21. The present issue of money in general does not correspond with the requirements per head, and cannot therefore satisfy all the needs of the workers. The issue of money ought to correspond with the growth of population and thereby children also must absolutely be reckoned as consumers of currency from the day of their birth. The revision of issue is a material question for the whole world. (SSN, of UCC, IMF, Issued at Birth upon the chattel)

22. YOU ARE AWARE THAT THE GOLD STANDARD HAS BEEN THE RUIN OF THE STATES WHICH ADOPTED IT, FOR IT HAS NOT BEEN ABLE TO SATISFY THE DEMANDS FOR MONEY, THE MORE SO THAT WE HAVE REMOVED GOLD FROM CIRCULATION AS FAR AS POSSIBLE.

GENTILE STATES BANKRUPT

23. With us the standard that must be introduced is the cost of working-man power, whether it be reckoned in paper or in wood. We shall make the issue of money in accordance with the normal requirements of each subject, adding to the quantity with every birth and subtracting with every death.

24. The accounts will be managed by each department, each circle.

25. In order that there may be no delays in the paying out of money for State needs the sums and terms of such payments will be fixed by decree of the ruler; this will do away with the protection by a ministry of one institution to the detriment of others.

26. The budgets of income and expenditure will be carried out side by side that they may not be obscured by distance one to another.

27. The reforms projected by us in the financial institutions and principles of the GOYIM will be clothed by us in such forms as will alarm nobody. We shall point out the necessity of reforms in consequence of the disorderly darkness into which the GOYIM by their irregularities have plunged the finances. (Secretly introduced, Make Maraka Great Again?) The first irregularity, as we shall point out, consists in their beginning with drawing up a single budget which year after year grows owing to the following cause: this budget is dragged out to half the year, then they demand a budget to put things right, and this they expend in three months, after which they ask for a supplementary budget, and all this ends with a liquidation budget. But, as the budget of the following year is drawn up in accordance with the sum of the total addition, the annual departure from the normal reaches as much as 50 per cent in a year, and so the annual budget is trebled in ten years. Thanks to such methods, allowed by the carelessness of the GOY States, their treasuries are empty. The period of loans supervenes, and that has swallowed up remainders and brought all the GOY States to bankruptcy. (The United States was declared “bankrupt” at the Geneva Convention of 1929! [see 31 USC 5112, 5118, and 5119).

28. You understand perfectly that economic arrangements of this kind, which have been suggested to the GOYIM by us, cannot be carried on by us.

29. Every kind of loan proves infirmity in the State and a want of understanding of the rights of the State. Loans hang like a sword of Damocles over the heads of rulers, who, instead of taking from their subjects by a temporary tax, come begging with outstretched palm of our bankers. Foreign loans are leeches which there is no possibility of removing from the body of the State until they fall off of themselves or the State flings them off. But the GOY States do not tear them off; they go on in persisting in putting more on to themselves so that they must inevitably perish, drained by voluntary blood-letting.

TYRANNY OF USURY

30. What also indeed is, in substance, a loan, especially a foreign loan? A loan is – an issue of government bills of exchange containing a percentage obligation commensurate to the sum of the loan capital. If the loan bears a charge of 5 per cent, then in twenty years the State vainly pays away in interest a sum equal to the loan borrowed, in forty years it is paying a double sum, in sixty – treble, and all the while the debt remains an unpaid debt.

2017, Twenty One Trillion and that is just their estimate…..

31. From this calculation it is obvious that with any form of taxation per head the State is baling out the last coppers of the poor taxpayers in order to settle accounts with wealth foreigners, from whom it has borrowed money (Independent Federal Reserve) instead of collecting these coppers for its own needs without the additional interest. (Stealthily giving authority of printing money to the Independent foreign owned Federal Reserve, Rothschild Bankers)

32. So long as loans were internal the GOYIM only shuffled their money from the pockets of the poor to those of the rich,

but when we bought up the necessary person in order to transfer loans into the external sphere, (16th Amendment, 14th amendment “Persons” enslaved all citizens)

all the wealth of States flowed into our cash- boxes and all the GOYIM began to pay us the tribute of subjects. (Willing chattel, bond servants to Satan’s Sinai-GOG)

33. If the superficiality of GOY kings on their thrones in regard to State affairs and the venality of ministers or the want of understanding of financial matters on the part of other ruling persons have made their countries debtors to our treasuries to amounts quite impossible to pay it has not been accomplished without, on our part, heavy expenditure of trouble and money.

Here is where Dumpity Trump, “Making Maraka Great again” comes in to once again Deceive the Goyim…..

34. Stagnation of money will not be allowed by us and therefore there will be no State interest-bearing paper, except a one per- cent series, so that there will be no payment of interest to leeches that suck all the strength out of the State. The right to issue interest-bearing paper will be given exclusively to industrial companies who will find no difficulty in paying interest out of profits, whereas the State does not make interest on borrowed money like these companies, for the State borrows to spend and not to use in operations.

35. Industrial papers will be bought also by the government which from being as now a paper of tribute by loan operations will be transformed into a lender of money at a profit. This measure will stop the stagnation of money, parasitic profits and idleness, all of which were useful for us among the GOYIM so long as they were independent but are not desirable under our rule.

Under Jew-risdiction of the Talmudic Hasidic jews of Sanhedrin the Sinai-Gog of Satan via…

https://www.congress.gov/bill/102nd-congress/house-joint-resolution/104/text

36. How clear is the undeveloped power of thought of the purely brute brains of the GOYIM, as expressed in the fact that they have been borrowing from us with payment of interest without ever thinking that all the same these very moneys plus an addition for payment of interest must be got by them from their own State pockets in order to settle up with us. What could have been simpler than to take the money they wanted from their own people?

Instead they Robbed the People via the 16th Amendment to steel and rob the American People, to Foreclose their Properties for the debt to these jewish Bankers of Satan’s Sinai-GOG.

37. But it is a proof of the genius of our chosen mind that we have contrived to present the matter of loans to them in such a light that they have even seen in them an advantage for themselves.

Your Congress, Both Demon-Crats and Publicans, you have so foolishy accepted and endorsed. How think you they are elected medium class to become filthy rich in that cesspool the “District of Columbia” where they have made their own immunity for their seditious and Treasonous crimes against the People?

38. Our accounts, which we shall present when the time comes, in the light of centuries of experience gained by experiments made by us on the GOY States, will be distinguished by clearness and definiteness and will show at a glance to all men the advantage of our innovations. They will put an end to those abuses to which we owe our mastery over the GOYIM, but which cannot be allowed in our kingdom.

39. We shall so hedge about our system of accounting that neither the ruler nor the most insignificant public servant will be in a position to divert even the smallest sum from its destination without detection or to direct it in another direction except that which will be once fixed in a definite plan of action. (this why a “private corporation,” known as the “Internal Revenue Service,” is in charge of collecting the “payments” of the “Income Taxes” and the IRS always deposits those “payments” to the Federal Reserve bank and never to the Treasury of the United States).

40. And without a definite plan it is impossible to rule. Marching along an undetermined road and with undetermined resources brings to ruin by the way heroes and demi-gods.

41. The GOY rulers, whom we once upon a time advised should be distracted from State occupations by representative receptions, observances of etiquette, entertainments, were only screens for our rule. The accounts of favorite courtiers who replaced them in the sphere of affairs were drawn up for them by our agents, and every time gave satisfaction to short-sighted minds by promises that in the future economics and improvements were foreseen …. Economics from what? From new taxes? – were questions that might have been but were not asked by those who read our accounts and projects.

42. You know to what they have been brought by this carelessness, to what pitch of financial disorder they have arrived, notwithstanding the astonishing industry of their peoples ….

1. To what I reported to you at the last meeting I shall now add a detailed explanation of internal loans. Of foreign loans I shall say nothing more, because they have fed us with national moneys of the GOYIM, but for our State there will be no foreigners, that is, nothing external.

The Vipers have transferred all of the world’s wealth to that Great Harlot City, Mystery Babylon, that spiritual Sodom and Egypt, where our Lord was crucified, jerusalem O’ jerusalem…and now they will foreclose to finish their vision, but they shall fail, indeed…

2. We have taken advantage of the venality of administrators and slackness of rulers to get our moneys twice, thrice and more times over, by lending to the GOY governments moneys which were not at all needed by the States. Could anyone do the like in regard to us? …. Therefore, I shall only deal with the details of internal loans.

3. States announce that such a loan is to be concluded and open subscriptions for their own bills of exchange, that is, for their interest-bearing paper. That they may be within the reach of all the price is determined at from a hundred to a thousand; and a discount is made for the earliest subscribers. Next day by artificial means the price of them goes up, the alleged reason being that everyone is rushing to buy them. In a few days the treasury safes are as they say overflowing and there’s more money than they can do with. The subscription, it is alleged, covers many times over the issue total of the loan; in this lies the whole stage effect – look you, they say, what confidence is shown in the government’s bills of #`! exchange.

4. But when the comedy is played out there emerges the fact that a debit and an exceedingly burdensome debit has been created. For the payment of interest it becomes necessary to have recourse to new loans, which do not swallow up but only add to the capital debt. And when this credit is exhausted it becomes necessary by new taxes to cover, not the loan, BUT ONLY THE INTEREST ON IT. These taxes are a debit employed to cover a debit …. (Government Shutdowns)

5. Later comes the time for conversions, but they diminish the payment of interest without covering the debt, and besides they cannot be made without the consent of the lenders; on announcing a conversion a proposal is made to return the money to those who are not willing to convert their paper. If everybody expressed his unwillingness and demanded his money back, the government would be hooked on their own files and would be found insolvent and unable to pay the proposed sums. By good luck the subjects of the GOY governments, knowing nothing about financial affairs, have always preferred losses on exchange and diminution of interest to the risk of new investments of their moneys, and have thereby many a time enabled these governments to throw off their shoulders a debit of several millions.

6. Nowadays, with external loans, these tricks cannot be played by the GOYIM for they know that we shall demand all our moneys back.

7. In this way in acknowledged bankruptcy will best prove to the various countries the absence of any means between the interest of the peoples and of those who rule them.

The Dumbmasses have yet to awaken from these Thefts

8. I beg you to concentrate your particular attention upon this point and upon the following: nowadays all internal loans are consolidated by so-called flying loans, that is, such as have terms of payment more or less near. These debts consist of moneys paid into the savings banks and reserve funds. If left for long at the disposition of a government these funds evaporate in the payment of interest on foreign loans, and are placed by the deposit of equivalent amount of RENTS.

9. And these last it is which patch up all the leaks in the State treasuries of the GOYIM.

10. When we ascend the throne of the world all these financial and similar shifts, as being not in accord with our interests, will be swept away so as not to leave a trace, as also will be destroyed all money markets, since we shall not allow the prestige of our power to be shaken by fluctuations of prices set upon our values, which we shall announce by law at the price which represents their full worth without any possibility of lowering or raising. (Raising gives the pretext for lowering, which indeed was where we made a beginning in relation to the values of the GOYIM.)

11. We shall replace the money markets by grandiose government credit institutions, the object of which will be to fix the price of industrial values in accordance with government views. These institutions will be in a position to fling upon the market five hundred millions of industrial paper in one day, or to buy up for the same amount. In this way all industrial undertakings will come into dependence upon us. You may imagine for yourselves what immense power we shall thereby secure for ourselves ….

1. In all that has so far been reported by me to you, I have endeavored to depict with care the secret of what is coming, of what is past, and of what is going on now, rushing into the flood of the great events coming already in the near future, the secret of our relations to the GOYIM and of financial operations. On this subject there remains still a little for me to add.

2. IN OUR HANDS IS THE GREATEST POWER OF OUR DAY – GOLD: IN TWO DAYS WE CAN PROCURE FROM OUR STOREHOUSES ANY QUANTITY WE MAY PLEASE.

For they have gathered all the earths gold into their hands, save a few measly tons. These Vipsers of Satan’s Sanhedrin intend to Build their Third Temple of Abominations of these Herodian Money Changers, to anoint that Son of Perdition to be “Revealed” that False Christ, Moshiach Ben David, who their TWO FOLD Children of Hell evangelical Noahide proselytes call now Yeshua HaMashiach, for the Fallen away unto the fables of the jews has occurred…….

3. Surely there is no need to seek further proof that our rule is predestined by God? (Their god they serve, that Tetragrammaton YHWH, their flesh god, Satan, the lord of their mammon) Surely we shall not fail with such wealth to prove that all that evil which for so many centuries we have had to commit has served at the end of ends the cause of true well- being – the bringing of everything into order?

The Ordo Ab Chao of their god wannabe SATAN they Serve, that Tetragrammaton and Lucifer

Though it be even by the exercise of some violence, yet all the same it will be established. We shall contrive to prove that we are benefactors who have restored to the rent and mangled earth the true good and also freedom of the person, and therewith we shall enable it to be enjoyed in peace and quiet, with proper dignity of relations, on the condition, of course, of strict observance of the laws established by us.

Satan’s Seven Noahide Laws, HJR 104-PL 102-14

We shall make plain therewith that freedom does not consist in dissipation and in the right of unbridled license any more than the dignity and force of a man do not consist in the right of everyone to promulgate destructive principles in the nature of freedom of conscience, equality and a like, that freedom of the person in no wise consists in the right to agitate oneself and others by abominable speeches before disorderly mobs, and that true freedom consists in the inviolability of the person who honorably and strictly observes all the laws of life in common, that human dignity is wrapped up in consciousness of the rights and also of the absence of rights of each, and not wholly and solely in fantastic imaginings about the subject of one’s EGO.

4. One authority will be glorious because it will be all-powerful, will rule and guide, and not muddle along after leaders and orators shrieking themselves hoarse with senseless words which they call great principles and which are noting else, to speak honestly, but utopian …. Our authority will be the crown of order, and in that is included the whole happiness of man. The aureole of this authority will inspire a mystical bowing of the knee before it and a reverent fear before it of all the peoples. True force makes no terms with any right, not even with that of God: none dare come near to it so as to take so much as a span from it away.

1. That the peoples may become accustomed to obedience it is necessary to inculcate lessons of humility and therefore to reduce the production of articles of luxury. By this we shall improve morals which have been debased by emulation in the sphere of luxury. We shall re-establish small master production which will mean laying a mine under the private capital of manufactures. This is indispensable also for the reason that manufacturers on the grand scale often move, though not always consciously, the thoughts of the masses in directions against the government. A people of small masters knows nothing of unemployment and this binds him closely with existing order, and consequently with the firmness of authority. For us its part will have been played out the moment authority is transferred into our hands. Drunkenness also will be prohibited by law and punishable as a crime against humanness of man who is turned into a brute under the influence of alcohol.

KJV Rev. 17:12

12 And the ten horns which thou sawest are ten kings, which have received no kingdom as yet; but receive power as kings one hour with the beast.

2. Subjects, I repeat once more, give blind obedience only to the strong hand which is absolutely independent of them, for in it they feel the sword of defense and support against social scourges …. What do they want with an angelic spirit in a king? (Jesus the KING of KINGS)What they have to see in him is the personification of force and power.

Rest assured Vipers you will indeed see this in That Day of the LORDS Wrath at the 7th Trumpet Call

3. The supreme lord who will replace all now existing ruler, dragging in their existence among societies demoralized by us, societies that have denied even the authority of God, from whose midst breads out on all sides the fire of anarchy, must first of all proceed to quench this all-devouring flame. Therefore he will be obliged to kill off those existing societies, though he should drench them with his own blood, that he may resurrect them again in the form of regularly organized troops fighting consciously with every kind of infection that may cover the body of the State with sores.

He Comes with ten Thou-sands of his Saints

4. This Chosen One of God (Chosen by Satan, the SON of Perdition to be REVEALED by these Vipers Sanhedrin of Satan) is chosen from above to demolish the senseless forces moved by instinct and not reason, by brutishness and humanness. These forces now triumph in manifestations of robbery and every kind of violence under the mask of principles of freedom and every kind of violence under the mask of principles of freedom and rights. They have overthrown all forms of social order to erect on the ruins of the throne of the King of the Jews; but their part will be played out the moment he enters into his kingdom. Then it will be necessary to sweep them away from his path, on which must be left no knot, no splinter.

5. Then will it be possible for us to say to the peoples of the world: Give thanks to God and bow the knee before him who bears on his front the seal of the predestination of man, to which God himself has led his star that none other but Him might free us from all the before-mentioned forces and evils.

Their Mashiach Ben David, AKA evangelical proselyte Noahide slaves Yeshu Ha Mashiach and his six poited star of Remphan and Chiun and Molech, that they have made with their hands, HIS Mark of his name, whom they shall worship, in fact already do…

1. I pass now to the method of confirming the dynastic roots of King David to the last strata of the earth.

2. This confirmation will first and foremost be included in that which to this day has rested the force of conservatism by our learned elders of the conduct of the affairs of the world, in the directing of the education of thought of all humanity.

Aholah, Dan, Sanhedrin, Chabad Lubavitch, right wing, Orthodoc jewry and their conservative evangelical proselytes, GOP Publicans, Made Two Fold the Children of Hell, their freemasons, Baptist, Catholicos and all man made “Religions” of the earth.

3. Certain members of the seed of David will prepare the kings and their heirs, selecting not by right of heritage but by eminent capacities, inducting them into the most secret mysteries of the political, into schemes of government, but providing always that none may come to knowledge of the secrets. The object of this mode of action is that all may know that government cannot be entrusted to those who have not been inducted into the secret places of its art ….

Every thing hidden is to be completely REVEALED, Vipers of Hell

4. To these persons only will be taught the practical application of the forenamed plans by comparison of the experiences of many centuries, all the observations on the politico-economic moves and social sciences – in a word, all the spirit of laws which have been unshakably established by nature herself for the regulation of the relations of humanity.

Changing the times and the Law

5. Direct heirs will often be set aside from ascending the throne if in their time of training they exhibit frivolity, softness and other qualities that are the ruin of authority, which render them incapable of governing and in themselves dangerous for kingly office.

6. Only those who are unconditionally capable for firm, even if it be to cruelty, direct rule will receive the reins of rule from our learned elders.

7. In case of falling sick with weakness of will or other form of incapacity, kings must by law hand over the reins of rule to new and capable hands.

8. The king’s plan of action for the current moment, and all the more so for the future, will be unknown, even to those who are called his closest counselors.

His three kings in the Kings Chambers……….

https://dafyomi.co.il/yevamos/insites/ye-dt-109.htm

The VILNA GA’ON supports Rashi’s interpretation. He explains that when the Sanhedrin convenes, ten of its most prestigious members sit in the middle of the group, surrounded by the other sixty. Those are the “sixty mighty men” who surround “the bed of Shlomo.” (The ten in the middle correspond to the seven “Ro’ei Pnei ha’Melech” and the three “Shomrei ha’Saf” in the court of a mortal king who are closest to the king, who correspond to the ten in the court of the King of kings; see Megilah 23a. The verse in Melachim II (25:19), which associates these authoritative members of the king’s court with sixty other men, appears in the context of a discussion of the members of the Sanhedrin.)

KING OF THE JEWS

9. Only the king and the three who stood sponsor for him will know what is coming.

and the three “Shomrei ha’Saf” in the court of a mortal king who are closest to the king, who correspond to the ten in the court of the King of kings; see Megilah 23a.

10. In the person of the king who with unbending will is master of himself and of humanity all will discern as it were fate with its mysterious ways. None will know what the king wishes to attain by his dispositions, and therefore none will dare to stand across an unknown path.

Wanna Bet?

11. It is understood that the brain reservoir of the king must correspond in capacity to the plan of government it has to contain. It is for this reason that he will ascend the throne not otherwise than after examination of his mind by the aforesaid learned elders.

12. That the people may know and love their king, it is indispensable for him to converse in the market-places with his people. This ensures the necessary clinching of the two forces which are now divided one from another by us by the terror.

13. This terror was indispensable for us till the time comes for both these forces separately to fall under our influence.

The jews and their goyim proselytes who are responsible for all who are slain upon the earth

14. The king of the Jews must not be at the mercy of his passions, and especially of sensuality: on no side of his character must he give brute instincts power over his mind. Sensuality worse than all else disorganizes the capacities of the mind and clearness of views, distracting the thoughts to the worst and most brutal side of human activity.

15. The prop of humanity in the person of the supreme lord of all the world of the holy seed of David must sacrifice to his people all personal inclinations.

16. Our supreme lord must be of an exemplary irreproachability. przion.htm

For those of you who have not yet read this article, you may and them who have reflect back the rabid ribeyes comments….of the coming temporary Utopia of Greater Itsreallyhell……..and her daughters of whoredom to come soon.

https://noahidenews.com/2018/01/17/the-imminent-coming-of-false-christ/

“In today’s society, many people are repulsed by the breakdown of ethical and moral standards. Life is cheap, crime is rampant, drug and alcohol abuse are on the increase, children have lost respect for their elders. At the same time, technology has advanced in quantum leaps. (The Moral decay promoted by Lucifers minions and their proselytes) There is no doubt that today man has all the resources—if channeled correctly—to create a good standard of living for all mankind. He lacks only the social and political will. Moshiach will inspire all men to fulfill that aim.”

Did Congress & Trump Provide the Ultimate TAX Remedy? Hidden In the Rules?

THEY JUST BROKE THE ABUSIVE U.S. TAX SYSTEM WITH THE NEW INCOME TAX LAW (H.R. 1 – Dec. 2017)

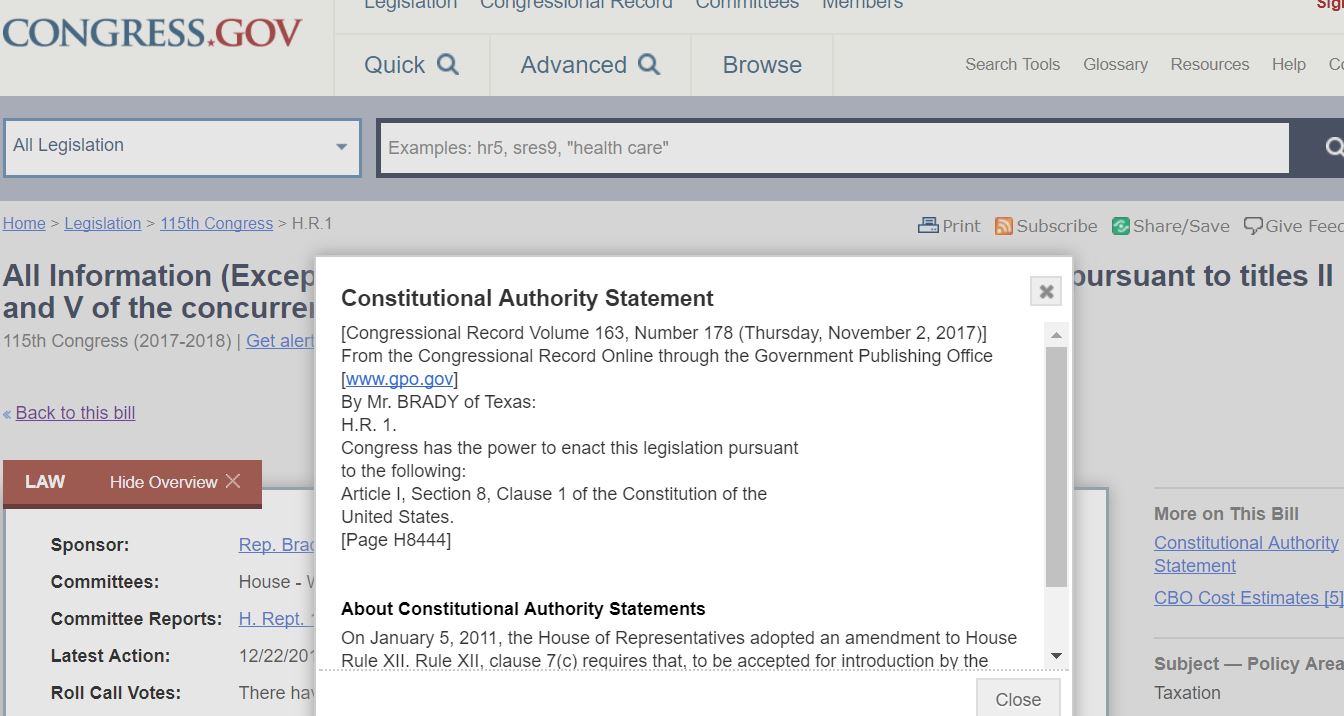

LINK TO BILL – then click on Constitutional Authority Statement

The new federal personal income tax law, H.R. 1, – that was just enacted into law by Congress in December 2017, and already made effective as of January 1st, 2018, has the immediate legal effect of:

1. completely disemboweling and destroying the I.R.S.’ current personal income tax collection and enforcement practices and operations, by removing them entirely and completely from all legitimate constitutional authority to act to enforce the direct taxation of income under the 16th Amendment, as practiced for the last 60 years;

2. strips the federal Department of Justice naked in the courtroom of all of its illegitimate constitutional arguments that have been made in the courtroom for the last 60 years, to sustain the federal court’s (both district and tax courts’) erroneous enforcement of a direct and unapportioned tax upon the income of We theAmerican People under alleged authority of the 16th Amendment; and

3. completely exposes the federal judiciary’s unlawful enforcement of the federal personal income tax under the 16th Amendment over the last 60 years of American history, as nothing but a complete and total judicially committed fraud that plainly and clearly can now be seen as the true judicial conspiracy of sedition that it is,

– to undermine and remove the constitutional limitations placed upon the federal taxing powers, in order to enforce the unconstitutionally direct taxation of the labors and work (“wages” and “salaries“) of the American People, in order to fund, not the legitimate operation of the government, but the constitutionally unauthorized progressive, liberal, Fabian, socialist programs effecting the re-distribution of wealth that have been by used by the politicians to create the welfare based, class warfare system of taxation that has resulted in the divisive destruction of America, its people’s Freedom, Liberty, private property, and equal rights;

– by expanding the judicial authority beyond that which is constitutionally authorized, to enable the federal judiciary to constitutionally usurp the legislative authority of the Congress, through the judicial enforcement of only the perverted judicial Fabian opinions they issue, in place of the actual written constitutional tax law that is authorized and exists.

What ? You may say – that’s crazy. What the hell are you talking about ?

It’s the same tax it’s always been ! There’s nothing new in the law that could do that ! Yea, – that’s right, it’s the same income tax law that it has always been, and now they have admitted it on the Congressional Record, and their world is about to change, – well, actually, implode.

Congress has no idea of what they have done, or of the true extent or size of the catastrophe within the tax enforcement system, that they have wrought with the new income tax law, and few Americans, if any have realized it yet,

– but any honest lawyer will tell you (after reading this) that everything you are about to read (and have read up to this point in this article) is irrefutably true.

FACT: For the last 60 years the IRS has been issuing income tax collection correspondence to Americans asserting that American citizens owe the payment of an income tax on their work, because of the adoption of the 16th Amendment. This claim to legal authority is all over their website; it is in their “frivolous Arguments” propaganda publications, where they repeatedly assert the income taxing authority under the 16th Amendment, and label as frivolous any reference made to the limitations on the taxing powers imposed under Article I of the Constitution; and, it is in the pleadings made on the record of the court by the United States as a plaintiff, in every tax case prosecuted in the federal courts in the last 30 years.

FACT: The Department of Justice attorneys argue in every single income tax case prosecuted in the federal courts, that the income tax is owed by the individual defendant as a function of the 16th Amendment alone, without use or need of any “applicability” of the authorized indirect Article I, Section 8, impost, duty and excise taxing powers.

FACT: For the last 60 years the federal courts have been wrongfully allowing and upholding the constitutionally prohibited, and therefore unconstitutional, direct taxation of the alleged gross income of the American People, created as a function of all of their labors and work, as a direct tax without apportionment, under alleged authority conferred under the 16th Amendment to tax “… income, from whatever source derived, without apportionment, and without regard to any census or enumeration. ”

FACT: The 16th Amendment has no enabling enforcement clause in it, that would constitutionally authorizes the U.S. Congress to write any law to enforce any power alleged newly created or authorized under authority of the Amendment alone.

FACT: There are Amendments to the Constitution, both before and after the 16th Amendment, that do have and clearly contain an enabling enforcement clause within them, irrefutably proving the absence within the Amendment, of such alleged grant of any new enforceable power, is intentional.

FACT: In assessing the legal effect of the 16th Amendment, the Supreme Court plainly said in 1916 that “the Sixteenth Amendment conferred no new power of taxation“. “. . . The provisions of the Sixteenth Amendment conferred no new power of

taxation but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out

of the category of indirect taxation to which it inherently belonged . . .”

Stanton v. Baltic Mining Co., 240 U.S. 103, 112-13 (1916)

FACT: The Article I, Section 8, clause 1, authorities to tax only indirectly, by uniform

impost, duty and excise, do not reach the labors of the American people with legal effect. This is why the federal government has argued for sixty years that the 16th Amendment was the sole basis for the enforcement of the income tax imposed by Section 1 of Title 26 United States Code (Title 26 is also called the I.R.C.). In speaking of the power to tax by ‘duties,’ ‘imposts,’ and ‘excises,’ the Supreme Court has consistently said:

” ‘We think that they were used comprehensively, to cover customs and

excise duties imposed on importation, consumption, manufacture, and sale of certain commodities, privileges, particular business transactions, vocations, occupations, and the like.’ Duties and imposts are terms commonly applied to levies made by governments on the importation or exportation of commodities. Excises are ‘taxes laid upon the manufacture, sale, or consumption of commodities within the country, upon licenses to pursue certain occupations, and upon corporate privileges.‘ Cooley, Const. Lim. 7th ed. 680. The tax under consideration, as we have construed the statute, may be described as an excise upon the particular privilege of doing business in a corporate capacity, i. e., with the advantages which arise from corporate or quasi corporate organization; or, when applied to insurance companies, for doing the business of such companies. As was said in the Thomas Case, 192 U. S. supra, the requirement to pay such taxes involves the exercise of privileges, and the element of absolute and unavoidable demand is lacking. If business is not done in the manner described in the statute, no tax is payable.

If we are correct in holding that this is an excise tax, there is nothing in the

Constitution requiring such taxes to be apportioned according to population. Pacific Ins. Co. v. Soule, 7 Wall. 433, 19 L. ed. 95; Springer v. United States, 102 U.S. 586 , 26 L. ed. 253; Spreckels Sugar Ref. Co. v. McClain, 192 U.S. 397 , 48 L. ed. 496, 24 Sup. Ct. Rep. 376.“ Flint v. Stone Tracy Co. , 220 US 107, 151-152 (1911)” Thomas v. United States, 192 U.S. 363 , 48 L. ed. 481, 24 Sup. Ct. Rep. 305 “Excises are “taxes laid upon the manufacture, sale or consumption of commodities within the country, upon licenses to pursue certain occupations, and upon corporate privileges … the requirement to pay such taxes involves the exercise of the privilege and if business is not done in the manner described no tax is payable…it is the privilege which is the subject of the tax and not the mere buying, selling or handling of goods. ” Cooley, Const. Lim., 7th ed., 680.” Flint, supra, at 151; Flint v. Stone Tracy Co., 220 U.S. 107 (1911)1

Which is mirrored in Black’s Law Dictionary: “Excise taxes are taxes “laid upon the manufacture, sale or consumption of commodities within the country, upon licenses to pursue certain occupations, and upon corporate privileges.” Flint v. Stone Tracy Co., 220 U.S. 107, 31 S.Ct. 342, 349 (1911); or a tax on privileges, syn. “privilege tax”. Black’s Law Dictionary 6th Edition

“The subject matter of taxation open to the power of the Congress is as comprehensive as that open to the power of the states, though the method of apportionment may at times be different. “The Congress shall have power to lay and collect taxes, duties, imposts and excises.” Art. 1, § 8. If the tax is a direct one, it shall be apportioned according to the census or enumeration. If it is a duty, impost, or excise, it shall be uniform throughout the United States. Together, these classes include every form of tax appropriate to sovereignty. Cf. Burnet v. Brooks, 288 U. S. 378, 288 U. S. 403, 288 U. S. 405; Brushaber v. Union Pacific R. Co., 240 U. S. 1 , 240 U. S. 12.” Steward Mach. Co. v. Collector, 301 U.S. 548 (1937), at 581

“The [income] tax being an excise, its imposition must conform to the canon of uniformity. There has been no departure from this requirement. According to the

settled doctrine the uniformity exacted is geographical, not intrinsic. Knowlton v. Moore, supra, p. 178 U. S. 83; Flint v. Stone Tracy Co., supra, p. 220 U. S. 158; Billings v. United States, 232 U. S. 261, 232 U. S. 282; Stellwagen v. Clum, 245 U. S. 605, 245 U. S. 613; LaBelle Iron Works v. United States, 256 U. S. 377, 256 U. S. 392; Poe v. Seaborn, 282 U. S. 101, 282 U. S. 117; Wright v. Vinton Branch Mountain Trust Bank, 300 U. S. 440.” Steward Mach. Co. v. Collector, 301 U.S. 548 (1937), at 583 “Whether the tax is to be classified as an “excise” is in truth not of critical importance. If not that, it is an “impost” (Pollock v. Farmers’ Loan & Trust Co., 158 U. S. 601, 158 U. S. 622, 158 U. S. 625; Pacific Insurance Co. v. Soble, 7 Wall. 433, 74 U. S. 445), or a “duty” (Veazie Bank v. Fenno, 8 Wall. 533, 75 U. S. 546, 75 U. S. 547; Pollock v. Farmers’ Loan & Trust Co., 157 U. S. 429, 157 U.

S. 570; Knowlton v. Moore, 178 U. S. 41, 178 U. S. 46). A capitation or other

“direct” tax it certainly is not.” Steward Mach. Co. v. Collector, 301 U.S. 548

(1937), at 581-2

1 Again, Flint v. Stone Tracy Co. is controlling and Constitutional law, having been cited and followed over 600 times by virtually every court as the authoritative definition of the scope of excise taxing power.

So, the granted taxing powers are conclusively defined within the U.S. Constitution: “Mr. Chief Justice Chase in The License Tax Cases, 5 Wall. 462, 72 U. S. 471, when he said: “It is true that the power of Congress to tax is a very extensive power. It is given in the Constitution, with only one exception and only two qualifications. Congress cannot tax exports, and it must impose direct taxes by the rule of apportionment, and indirect taxes by the rule of uniformity.

Thus limited, and thus only it reaches every subject, and may be exercised at discretion.” And although there have been from time to time intimations that there might be some tax which was not a direct tax nor included under the words “duties, imposts and excises,” such a tax, for more than one hundred years of national existence, has as yet remained undiscovered, notwithstanding the stress of particular circumstances [that] has invited thorough investigation into sources of revenue.” And with respect to the power to tax income the Supreme Court has said:

“The act now under consideration does not impose direct taxation upon property solely because of its ownership, but the tax is within the class which Congress is authorized to lay and collect under article 1, [section] 8, clause 1 of the Constitution, and described generally as taxes, duties, imposts, and excises, upon which the limitation is that they shall be uniform throughout the United States. Within the category of indirect taxation, as we shall have further occasion to show, is embraced a tax upon business done in a corporate capacity, which is the subject-matter of the [income] tax imposed in the act under consideration. The Pollock Case construed the tax there levied as direct, because it was imposed upon property simply because of its ownership. In the present case the tax is not payable unless there be a carrying on or doing of business in the designated capacity, and this is made the occasion for the tax, measured by the standard prescribed. The difference between the acts is not merely nominal, but rests upon substantial differences between the mere ownership of property and the actual doing of business in a certain way.” Flint v. Stone Tracy Co. , 220 US 107, 150 (1911) Which is repeatedly supported: “As has been repeatedly remarked, the corporation tax act of 1909 was not intended to be and is not, in any proper sense, an income tax law. This court had decided in the Pollock Case that the income tax law of 1894 amounted in effect to a direct tax upon property, and was invalid because not apportioned according to populations, as prescribed by the Constitution. The act of 1909 avoided this difficulty by imposing not an income tax, but an excise tax upon the conduct of business in a corporate capacity, measuring, however, the amount of tax by the income of the corporation, with certain qualifications prescribed by the act itself. Flint v. Stone Tracy Co. 220 U.S. 107 , 55 L. ed. 389, 31 Sup. Ct. Rep. 342, Ann. Cas. 1912 B, 1312; McCoach v. Minehill & S. H. R. Co. 228 U.S. 295 , 57 L. ed. 842, 33 Sup. Ct. Rep. 419; United States v. Whitridge (decided at this term, 231 U.S. 144 , 58 L. ed. –, 34 Sup. Ct. Rep. 24.” Stratton’s, supra at 414 So imposts and duties are taxes on imported and exported goods, i.e. : commodities and articles of commerce that are imported into, and or exported from, the United States of America. Imposts are also taxes on foreign “persons” and their activities in the United States (foreign individuals & companies, & organized operations like a foreign trust, charity, etc.). Imposts and duties are also taxes, where imposed, on persons in the U.S. territories and possessions, and on America citizens who are living and working in a foreign country under a tax treaty with the United States that allows the federal taxation of the American persons in that foreign country, under the active tax treaty.

So taxation, by impost and duty, by definition, fundamentally does not reach the labors of the American people conducted in the fifty states, where the labor does not involve any import or export, or other foreign activity. And Excise taxes are now accepted as being constitutionally defined by both law and precedent (over 600 times) as: “taxes laid upon the manufacture, sale or consumption of commodities within the country, upon licenses to pursue certain occupations, and upon corporate privileges … “.

But Title 15 U.S.C. Section 17, plainly and clearly states that: “The labor of a human being is not a commodity or article of commerce… “. Under the U.S. Constitution this law removes “the (domestic) labor of a human being (American citizens)” from subjectivity to any and all taxation by excise under Article I, Section 8.

This is of course why the United States’ IRS, DOJ, and the entire federal judiciary (at this point) PREVIOUSLY have had to claim in court for 50 years that – it is the 16th Amendment that authorizes the income tax, and not Article I, Section 8. Thus, under Article I of the Constitution, there is an admitted total lack of subjectivity of the citizens to any and all impost, duty or excise taxation on Labor, i.e.: the indirect taxation of the citizen’s labor, or a tax upon the exercise of his or her Right to Work resulting in the payment of “salary” or “wages“, does not apply to citizens, because it is not statutorily authorized, now made enforceable, as it is fundamentally outside of the legal reach, and scope of legal effect, of all of the granted Constitutional authorities to tax indirectly under authority of Article I, Section 8, clause 1 of the U.S. Constitution.

The reason why this is so important to understand, is because this basic information, concerning the proper, limited, application and enforcement of the constitutional, and constitutionally granted, powers to tax, is essential in properly and fully understanding the legal issue of the limited subject-matter jurisdiction of the federal courts that exists with respect to the taxation of the individual citizens. A proper and complete understanding of this legal issue, immediately leads to the realization that there is no constitutionally granted subject-matter jurisdiction that can be taken over a civil action to adjudicate and or enforce the claims that are alleged by the United States in any Complaint filed in a legal action that is filed in the federal courts to pursue the enforcement of the payment of a personal income tax against an individual American citizen as defendant. In the United States of America, under the Constitution of the United States of America, our federal courts are courts of only limited, specifically enumerated, constitutionally granted, powers, that only exist as written in the law. The courts cannot enforce ideas, or a philosophy, or custom or habit, or ritual, or beliefs, or even common sense.

The courts can only enforce the written law of the statutes of the Titles of United States Code. Nothing else. And of course, under the Constitution of the United States of America, a statute (law), can only be written by Congress where,

first: – the Constitution grants a specific power to be exercised by the Congress (as is done in Article I, Section 8); and second: the Constitution specifically grants the authority to the Congress to write law (as is done in Article I, Section 8, clause 18), with specific applicability to the enforcement of the power(s) granted, that was, or were, exercised in operational practice (enforcement) by the government (IRS).

So, the three required elements of our constitutional law in America, necessary to establish the subject-matter jurisdiction of the court that can be taken over any legal action, sufficient to allow that court to entertain and adjudicate the action in the court, are:

(1) a specific power must be granted by the Constitution or Amendment for Congress (the United States) to exercise;

(2) a specific grant of authority for Congress to write law must be made by the Constitution or Amendment, with respect to the administration and enforcement of the specific power granted in (#1) above 2; and,

(3) a specific statute must be legislatively enacted by an authorized Congress, with specific application to the enforcement of the specific power alleged granted and exercised in (#1) above, and madeenforceable with authorized law under (#2) above.

These fundamental elements of constitutional law, controlling the ability of a federal court to lawfully take a granted subject-matter jurisdiction over a legal claim made by complainant (like the United States) in the federal district court, combined with the irrefutable lack of any enabling enforcement clause that exists in the 16th Amendment as adopted, make the United States’ claims in the courts that the 16th Amendment is the foundational authority for the enforcement of the income tax against the individual citizens, on the mere basis of being a “person” with alleged “gross income”, appear dubious at best, and a complete and total lie at worst, as this lack of granted constitutional authority to write law under the 16th Amendment also explains the alleged tax-protestors’ claims of the last 50 years, that – if the tax is under the 16th Amendment, then the tax must be voluntary, as no law is constitutionally authorized to be written by Congress, and therefore no law can exist, or does exist, under the 16th Amendment that effects the income of the citizens directly, without the underlying foundational use of the impost, duty and excise taxing authorities of Article I first being made applicable.

i.e. : a specific enabling enforcement clause of the Constitution, or one of its Amendments, must be shown to have been made applicable to the specific taxing power alleged constitutionally granted, and operationally practiced under (#1) above;

So the lower federal district and circuit courts have over time, seditiously reversed the Supreme Court’s original and true holding in 1916 – that the income tax is authorized and is constitutional under the granted and enforceable indirect Article I taxing authorities, as a measure of the amount of the indirect tax that is imposed on the income derived from the impost, duty or excise taxable activities or persons,

– who are made subject by the tax law to the payment of the uniform impost, duty or excise;

– which does not constitute an unconstitutionally unapportioned direct tax. The Supreme Court plainly held in 1916, in the Brushaber v. Union Pacific RR Co., 240 US 1 (1916) and Stanton v. Baltic Mining Co., 240 U.S. 103 (1916) cases, that the income tax is an indirect tax under Article I, and is not a direct tax under the 16th Amendment.

Again: “. . . The provisions of the Sixteenth Amendment conferred no new power of taxation but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out of the category of indirect taxation to which it inherently belonged .”

Stanton v. Baltic Mining Co., 240 U.S. 103, 112-13 (1916) “It is clear on the face of this text that it does not purport to confer power to levy income taxes in a generic sense – an authority already possessed [under Article I, Section 8] and never questioned – or to limit and distinguish between one kind of income taxes and another, but that the whole purpose of the Amendment was to relieve all income taxes when imposed from apportionment from a consideration of the source whence the income was derived.” Brushaber, supra, at 17-8 “The various propositions are so intermingled as to cause it to be difficult to classify them. We are of opinion, however, that the confusion is not inherent, but rather arises from the conclusion that the Sixteenth Amendment provides for a hitherto unknown power of taxation, that is, a power to levy an income tax which although direct should not be subject to the regulation of apportionment applicable to all other direct taxes.

And the far-reaching effect of this erroneous assumption will be made clear by generalizing the many contentions advanced in argument to support it, . . .” Brushaber, supra, at 10-11 “…it clearly results that the [direct tax] proposition and the contentions under it, if acceded to, would cause one provision of the Constitution to destroy another; that is, they would result in bringing the provisions of the Amendment exempting a direct tax from apportionment into irreconcilable conflict with the general requirement that all direct taxes be apportioned. … This result … would create radical and destructive changes in our constitutional system and multiply confusion.” Brushaber v. Union Pac. R.R., 240 U.S. 1, 12

“The Sixteenth Amendment, although referred to in argument, has no real bearing and may be put out of view. As pointed out in recent decisions, it does not extend the taxing power to new or excepted subjects, but merely removes all occasion, which otherwise might exist, for an apportionment among the States of taxes laid on income, whether it be derived from one source or another. Brushaber v. Union Pacific R.R. Co., 240 U.S. 1, 17-19; Stanton v. Baltic Mining Co., 240 U.S. 103, 112-113.” These holdings in 1916 of course merely reasserted the Court’s long-standing recognition of the constitutional fact that the federal taxation of labor (without apportionment to the states for payment of the direct tax), is not a constitutionally granted taxing power, as labor has historically been perceived by the courts as a constitutionally protected Right, and outside of the granted internal Excise taxation powers. “As in our intercourse with our fellow-men certain principles of morality are assumed to exist, without which society would be impossible, so certain inherent rights lie at the foundation of all action, and upon a recognition of them alone can free institutions be maintained. These inherent rights have never been more happily expressed than in the Declaration of Independence, that new evangel of liberty to the people: ‘We hold these truths to be self-evident’ — that is so plain that their truth is recognized upon their mere statement — ‘that all men are endowed’ — not by edicts of Emperors, or decrees of Parliament, or acts of Congress, but ‘by their Creator with certain inalienable rights’ — that is, rights which cannot be bartered away, or given away, or taken away except in punishment of crime — ‘and that among these are life, liberty, and the pursuit of happiness, and to secure these’ — not grant them but secure them — ‘governments are instituted among men, deriving their just powers from the consent of the governed.’ “Among these inalienable rights, as proclaimed in that great document, is the right of men to pursue their happiness, by which is meant the right to pursue any lawful business or vocation,

. . . “It has been well said that, “The property which every man has in his own labor, as it is the original foundation of all other property, so it is the most sacred and inviolable [right] . . .” Adam Smith’s Wealth of Nations, Bk. I. Chap. 10.” [in Justice Field’s Concurrence in Butchers’ Union Co. v. Crescent City Co., 111 U.S. 746, 756 4 S.Ct. 652 (1884)] Justice Field was not alone in his assessment. He was joined in his concurrence by Justice Bradley, who, joined by JJ. Harlan and Woods, also concurred, but on the basis of Field’s reasoning, stating at p. 762:

“The right to follow any of the common occupations of life is an inalienable right; it was formulated as such under the phrase “pursuit of happiness” in the Declaration of Independence, which commenced with the fundamental proposition that “all men are created equal, that they are endowed by their Creator with certain inalienable rights; that among these are life, liberty, and the pursuit of happiness.” This right is a large ingredient in the civil liberty of the citizen.” “Included in the right of personal liberty and the right of private property partaking of a nature of each- is the right to make contracts for the acquisition of property. Chief among such contracts is that of personal employment, by which labor and other services are exchanged for money or other forms of property. If this right be struck down or arbitrarily interfered with, there is a substantial impairment of liberty in the long established constitutional sense.” Justice Pitney in Coppage v. Kansas, 236 U.S. 1, 14, 59 L.Ed. 441, L.R.A. 1915C, 960, 35 S.Ct.Rep. 240 (1915) “But the fundamental rights to life, liberty, and the pursuit of happiness, considered as individual possessions, are secured by those maxims of constitutional law which are the monuments showing the victorious progress of the race in securing to men the blessings of civilization under the reign of just and equal laws, so that, in the famous language of the Massachusetts Bill of Rights, the government of the commonwealth ‘may be a government of laws and not of men.’ For, the very idea that one man may be compelled to hold his life, or the means of living, or any material right essential to the enjoyment of life, at the mere will of another, seems to be intolerable in any country where freedom prevails, as being the essence of slavery itself.” Yick Wo v. Hopkins, 118 U.S. 356, 370 (1886) But the lower federal district and circuit courts have reversed this clear indirect “income tax” holding that was made by the Supreme Court in 1916, by invoking as controlling, not these true, controlling Supreme Court cases cited above (Brushaber & Stanton), but instead they invoke one of their own contradictory inferior opinions from the below list of inferior circuit court decisions that openly simply declare, erroneously (and obviously so), that the federal personal income tax is authorized by the 16th Amendment as a direct unapportioned tax that is laid on all of the income of all persons.

- United States v. Collins, 920 F.2d 619, 629 (10th Cir. 1990), (which simply asserts the tax is direct and unapportioned, reversing Brushaber without actually citing or quoting any text from that case opinion);

- Parker v. Comm’r, 724 F.2d 469 (5th Cir. 1984). (which also asserts the tax is direct and unapportioned, reversing Brushaber without citing or quoting any actual text from the case opinion);

- Lovell v. United States, 755 F.2d 517 (7th Cir. 1984), 11 The Broken Tax System http://www.Tax-Freedom.com (which simply cites to Parker v. Comm’r. to make its assertions);

- United States v. Sloan, 755 F.2d 517, 519 (7th Cir. 1984), (which simply cites to Lovell and Collins to make its assertions);

- In re Becraft, 885 F.2d 547, 548 (9th Cir. 1989), (which simply cites to Lovell and Parker to make its assertions). And so, as a result of the federal courts improperly using for the last 40 years these inferior, isolated, self-circular court decisions (upholding the direct unapportioned taxation of income under the 16th Amendment), actually reversing the Supreme Court’s true holding (upholding only indirect uniform taxation of income under Article I, Section 8), the federal personal income tax has been enforced for 60 years in the lower federal Tax Court and district and circuit courts, erroneously, as a direct unapportioned tax, in blatant violation of the prohibition on such direct taxation that is still constitutionally prohibited by Article I, Section 2, clause 3 and Article I, Section 9, clause 4 of the U.S. Constitution.

Which brings us back to the focus of this exposé, and the beginning of this paper,

– the new tax law H.R. 1 (Dec. 2017), made effective as law as of January 1, 2018. You see in 2011 the United States Congress passed another new law directly affecting the new tax law, requiring that all legislative Bills brought forward to the House floor for debate, contain within them a plain and clear statement identifying and declaring the alleged constitutional clause with the grant of authority that serves as the constitutional foundation to the congressional claim of a granted authority to write law with respect to the administration of the powers claimed therein, and proposed exercised under the new legislation.

So, what did they put in the Constitutional Authority Statement for H.R. 1, the new income tax law now in effect ? Did they actually write “the 16th Amendment” was the authority, as argued for 50 years, or something else ?NO! It’s either there or it isn’t.

First, it should be noted that the re-enactment of Title 26 U.S.C. (I.R.C.) Section 1, as done in H.R. 1, of course constitutes a re-enactment of exactly the same income taxing powers, and scheme of taxation (or lack thereof), as previously existed under the previous version of the income tax law, i.e. : the 1986 IRC code provisions of Title 26 U.S.C. (IRC) Section 1. Congress has simply adjusted the number of tax-brackets from seven to four, with different earnings thresholds and tax-rates associated with each of the four new tax-brackets, and with a new set of allowed or disallowed deductions and exemptions for everyone.

But, it is basically and essentially, an undeniable reimplementation of exactly the same scheme of graduated, bracketed, gross-income taxation (under IRC § 61) of taxable income (IRC § 63), as that (scheme of taxation) which has existed since 1913.

Supposedly, under this new law, nothing substantial or constitutionally foundational is believed to have been changed concerning or controlling the fundamental taxing power exercised, to tax income, and everything about the scheme is basically left unchanged, schematically identically the same as before (since the recodification of the tax law in 1986, which was also recodified (a new written version was created) in 1939 and 1954).

The “Constitutional Authority Statement” for the new law (26 USC (IRC) Section 1) plainly states: (next page) Lets look at that, closer:

As never before…It now plainly states that the Constitutional Authority for the enactment of the new income tax law enacted under H.R. 1, is not the 16th Amendmentat all, but relies solely on “ARTICLE I, SECTION 8, CLAUSE 1 of the Constitution of the United States.” for its authority. If the 16th amendment was intended as the authority, it would have been listed. It is NOT!

Uh-oh! You mean it isn’t the 16th Amendment after all? … and that claim of constitutional authority under the 16th Amendment as legal foundation to sustain the imposition and enforcement of the personal income tax, can never be made by the IRS, or in court by the United States attorneys, again, – ever !! In neither civil, nor criminal, tax prosecutions?

Finally, the true and correct constitutional authority for the federal personal income tax is plainly and clearly specified in the law, on the Congressional House record, as being established under ONLY Article I, Section 8, clause 1 of the U.S. Constitution, which contains only the grant of the required constitutional authority to tax, indirectly, by impost, duty and excise, which powers, by law (Title 15 USC Sec. 17) do not lawfully reach the labors or income of the American People with force of law though the proper and lawful invocation and enforcement upon individual persons of only the granted indirect taxing powers.

The new income tax law, H.R. 1, by completely removing the 16th Amendment as an arguable constitutional basis and legal foundation, or as the applicable constitutional authority that is allegeable as the constitutional authority for the imposition, withholding, collection, and enforcement of the personal income tax in the federal courts as a direct tax,

– completely strips the IRS, the DOJ, and the federal judiciary of all of their lawful ability to legally enforce on American citizens after January 1st, 2018, the federal personal income tax in the federal courts as it has been practiced since 1945.

Its’ over. The IRS, the DOJ, the federal judiciary are all eviscerated. The monstrous income tax FRAUD perpetrated by the federal courts on the American People is fully exposed now, naked to the world, and the behavior and opinions of the federal judiciary are exposed as nothing but the treasonous sedition they have always been. i.e. : communistic and not constitutional. Repugnant, disgusting, corrupted, polluted, perverted, ultra vires judicial behavior and opinions, all committed for sixty years outside of the granted constitutional authority that exists for the court to lawfully act under, is all exposed. Naked to the world.

The Emperor wears no clothes. This new constitutional clarification now proves it has all been conspiratorial judicial theft. Nothing more, and nothing less. The judicial crimes of the last sixty years, fraudulently perpetrated on the American People by the federal judiciary in the name of tax has all been pure unlawful and wrongful conversion of the constitutionally protected private property of We the People, under color of law, under color of office, and in the name of tax only;

– for there is no law becausenone is authorized, and there is no enforceable

direct tax or taxing power conferred under the 16th Amendment as previously used and deceptively claimed, because no such power is constitutionally made enforceable against the individual ‘person’, as opposed to one of the “several states”.

Article 1, Section 2, clause 3 – “Representatives and direct Taxes shall be apportioned amongst the several states which may be included within this Union”

AllAmerican citizens, in all 50 states, are all nowEXEMPT – as they always were, but is now clarified by constitutional as now clarified by congress), from any required payment or withholding of the federal personal income tax from their paycheck, earned at their place of employment in one of the fifty states, and everyone should therefore now claim EXEMPT on their W-4, as provided in law thereupon, under the supremacy-clause exemption from withholding, that is made at Title 26 USC (IRC) Section 3402(n), for informed employees to claim.

Go ahead, “Google” it, – “H.R. 1 Constitutional Authority Statement”. See for yourself. Without the use of the misapplication of the 16th Amendment to erroneously allege a direct tax on income that is owed by all “persons”, there can be no lawful enforcement of the personal income tax on the income of the American People, by any Department, Agency, Service, or any other group of men that exist within the federal government,

– like the IRS, the DOJ, the federal judiciary, or even the “United States of America” (as a plaintiff in the courts), without there first being the clear applicability of some impost, duty, or excise tax to measure, that lawfully and properly taxes the underlying

taxable (business, commodity, or trade based) activity from which the income is derived.

Therefore, if there is no impost, duty, or excise tax that exists in the written law of the United States Code (the written laws) that applies to the underlying taxable activity, resulting in “taxable income”, then there is no amount of “gross income” to measure as tax. And, since there is no impost, duty, or excise tax that exists in the written law of the United States Code (the written laws) that reaches either the “wages” or “salary” of the American People, earned by Right, as those terms (“wages” and “salary“) are not included in IRC Section 61 defining the sources of gross income constituting taxable income of an American citizen;

– but the terms are specifically included in IRC Section 1441(b), wherever “wages” or “salary” are earned by the non-resident alien person that is identified in law under IRC Section 1441(a). And, since it is only the foreign person (Follow this LINK and CLICK on Person see the definition – and also look up definition of individual in the code – it’s likely not you), who is made subject under the provisions of IRC Sections 7701(a)(16), to the collection of the federal personal income tax imposed in the code sections of Subtitle A (Chapters 1-6) of Title 26, which is where the original 1913 income tax laws are found in today’s law.

Subtitle A is the body of law that was enacted by Congress in 1913 as the federal personal income tax law, enacted under the original income tax legislation of the Underwood-Simmons Tariff Act of Oct. 3, 1913, then it has now become impossible (under the new H.R. 1 income tax law, ONLY under Article I, Section 8, authorities) for any party or person to lawfully withhold or collect any federal income tax from the payments made to an informed American citizen in one of the fifty states!

Oh, by the way, a Tariff, as enacted within the Underwood-Simmons Tariff Act of Oct. 3, 1913, is one form of an impost, which taxing power, when exercised in the 50 states, is limited in constitutional operation to the taxation of only foreign persons and imported foreign goods, commodities, and other taxable “articles of commerce“. An impost, in the form of an enacted tariff, has no internal application to thedomestic activity of American citizens conducted by Right within the fifty states, without any involvement with foreign goods or foreign persons.

So, as I said in the beginning: The new federal personal income tax law, H.R. 1, that was just enacted into law by Congress in December 2017, and already made effective as of January 1st, 2018, has the immediate legal effect of:

1. Completely disemboweling and destroying the I.R.S.’ current personal income tax collection and enforcement practices and operations, by removing them entirely and completely from all legitimate constitutional authority to act to enforce the direct taxation of income under the 16th Amendment, as practiced for the last 60 years; Exposing 60 years of IRS THEFT & UNLAWFUL CONVERSION BY FRAUD.

2. Strips the federal Department of Justice naked in the courtroom of all of its usual illegitimate constitutional arguments that have been made in the courtroom for the last 60 years, to sustain the federal court’s (both district and tax courts’) erroneous enforcement of a direct and unapportioned tax upon the income of We theAmerican People under alleged authority of the 16th Amendment (Exposing 60 years of DOJ FRAUD AND/OR STUPIDITY); and

3. Completely exposes the federal judiciary’s unlawful enforcement of the federal personal income tax under the 16th Amendment over the last 60 years of American history, as nothing but a complete and total judicially committed fraud that plainly and clearly can now be seen as the true judicial conspiracy of sedition that it is, to undermine and remove the constitutional limitations placed upon the federal taxing powers, in order to enforce the unconstitutionally direct taxation of the labors and work (“wages” and “salaries“) of the American People, in order to fund, not the legitimate operation of the government, but the constitutionally unauthorized progressive, liberal, Fabian, socialist programs effecting the re-distribution of wealth that are used to create the welfare-class and class warfare systems that are resulting in the destruction of America, Freedom, Liberty, private property, and equal rights, by expanding the judicial authority beyond that which is authorized, to enable the federal judiciary to constitutionally usurp the legislative authority of the Congress, through the judicial enforcement of only the perverted judicial Fabian opinions, in place of the actual written constitutional tax law that exists.

This clearly exposes 60 years of JUDICIAL FRAUD, ERROR, and ARROGANCE.